9 July 2025, United Kingdom – Mypinpad, a global innovator in mobile card payments acceptance and identity authentication software solutions, is proud to announce that its kernel has officially achieved Visa’s Tap to Consumer Device EMV Level 2 (L2) compliance for global use. This Visa L2 certification further cements Mypinpad’s leadership in secure, hardware-free payments on everyday consumer devices.

The Visa L2 certification validates the kernel’s compliance with Visa’s rigorous functional and operational specifications for Tap to Consumer Device deployments, ensuring the solution’s readiness for global rollout across acquirers, fintech and merchant partners.

“Consumer device applications such as Tap to Add, Tap to Verify, and Tap to Own Device are growing at an exponential rate as consumers experience the security and convenience of tapping their bank cards on their own phones,” said Barry Levett, CEO at Mypinpad. “With that comes the obligation to ensure our kernels meet the stringent requirements of the industry. Visa’s L2 certification validates our commitment to security and payments innovation, and strengthens our ability to power the next generation of software-based payment experiences across global markets.”

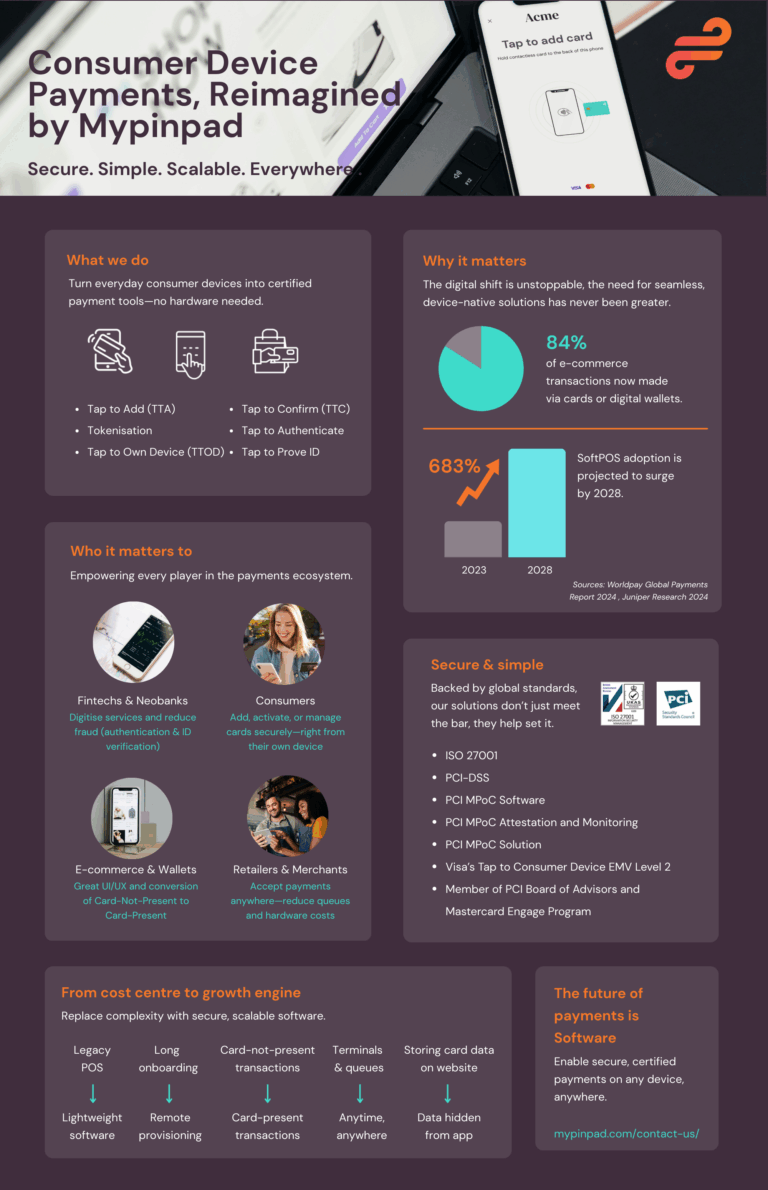

Mypinpad’s Tap to Consumer Device Kernel is central to its broader suite of certified consumer device solutions—including Tap to Own Device, Tap to Add, and Tap to Confirm/Verify. These innovations transform everyday smartphones and devices into secure, multifunctional commerce tools—eliminating the need for traditional hardware while maintaining the highest levels of compliance and user trust.

This latest achievement adds to a growing list of industry recognitions. Notably, Mypinpad is:

• Certified for PCI Mobile Payments on COTS (MPoC), the latest and most comprehensive standard for software-based payments acceptance,

• ISO 27001 certified, demonstrating its robust information security management practices, and

• A proud member of the PCI SSC Board of Advisors, helping shape the future of global payments security standards.

Notable disclaimer: When granted, Visa’s recognition of compliance with certain specifications is provided by Visa to verify operational characteristics important to Visa’s systems as a whole, but Visa recognition of compliance does not under any circumstances include any endorsement or warranty regarding the functionality, quality or performance of any particular product or service. Visa does not warrant any products or services provided by third parties. Visa’s recognition of compliance does not under any circumstances include or imply any product warranties from Visa, including, without limitation, any implied warranties of merchantability, fitness for purpose, or non–infringement, all of which are expressly disclaimed by Visa. All rights and remedies regarding products and services which have received Visa’s recognition of compliance shall be provided by the party providing such products or services, and not by Visa.

>> Learn more about Mypinpad’s consumer device innovation and how it works here

About Mypinpad

Mypinpad is a UK-headquartered B2B SaaS business with customers and employees in over 20 countries. Mypinpad strives to be the solution of choice for money on the move — making mobile transactions safe, easy and enjoyable. Its certified and patented technology is built on cloud-based open systems designed to be bank-grade secure and ready to scale, providing customers with the tools to grow and future-proof its business. By working together with partners, Mypinpad aims to drive financial inclusion for the benefit of millions globally.

Extract of the Compliance Recognition letter

Scope of Visa’s compliance recognition: This Compliance Recognition applies on a worldwide basis. Compliance Recognition does not supersede Visa Region-Specific Requirements, additional testing requirements as may be imposed by national testing bodies, financial institutions, network services providers, or other customers or requirements imposed by the Visa Product Brand Standards, Visa Ready Program, and/or Visa Global Brand Management.

Further conditions: As noted above, Visa performs limited testing regarding compliance with Evaluated Specifications, and the onus is on the Product Manufacturer to conduct testing to ensure that the Product works with other Visa approved/compliant products and that environmental conditions do not adversely affect performance of the Product. The Product was not tested while connected to a mobile network operator, an acquirer, or payment facilitator’s host communication network to determine whether environmental conditions affect the performance of the Product.

Compliance Recognition only applies to products that are identical to the Product that was the subject of the testing referenced in this letter. A product is not considered compliant by Visa, nor should it be promoted by you as compliant, if any aspect of that product (excluding any operating system version(s)) is different from the Product which is determined by Visa to be compliant as described in this letter.

Visa may request the Product Manufacturer to resubmit product samples that are identical to the samples tested and evaluated for compliance by Visa at any time if additional testing is required to investigate Product issues or potential non-compliance after the compliance recognition is granted.

All products submitted for testing are required to be submitted pursuant to a Visa International Service Association Approval Services Testing Agreement relevant for the product. Compliance Recognition granted in this letter is subject in all respects to the terms and conditions of the Visa International Service Association Approval Services Testing Agreement relevant for the product.

The issuance of this letter is further conditioned upon all necessary agreements having been executed, including without limitation, the applicable license agreements with Visa, and this letter shall be of no force and effect unless such agreements have been executed contemporaneously with or prior to the issuance of this letter.

Compliance Recognition is granted solely to the submitting Product Manufacturer and may not be assigned, transferred or sublicensed, either directly or indirectly, by operation of law or otherwise. Only the Product Manufacturer receiving a Visa Letter of Compliance for their product may claim that they have Compliance Recognition.

Visa may revoke Compliance Recognition at any time. Because Compliance Recognition may be revoked at any time, no Visa Client or other third party should rely on this letter without first confirming the continued effectiveness of Compliance Recognition with the applicable Visa Ready Program. Unless revoked earlier, Compliance Recognition shall remain in effect until July 08, 2028. Visa reserves the right to modify the terms or duration of Compliance Recognition at its sole discretion to accommodate business or security requirements. Even though Visa finds this Product compliant, as described in this letter, the Product Manufacturer is solely responsible for compliance with all applicable specifications and for all liabilities resulting from the use or distribution of the Product.