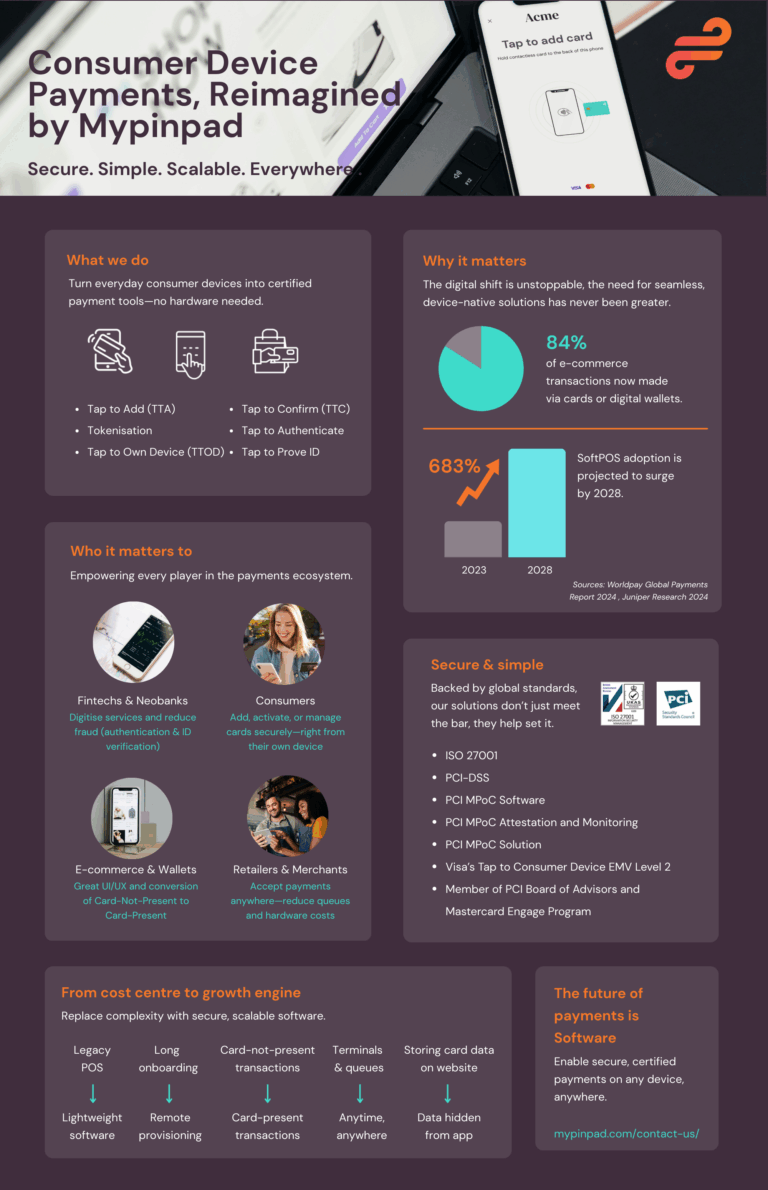

Mypinpad proudly announces the launch of Tap to Pay on iPhone in New Zealand. This innovative solution leverages iPhone’s trusted security features and user-friendly integration to deliver a secure, frictionless payment acceptance solution—and is a game-changer in a market where iPhones enjoy strong market presence.

27 November 2024, United Kingdom – Mypinpad, a global innovator in mobile card payment acceptance and identity authentication software solutions, proudly announces the launch of Tap to Pay on iPhone in New Zealand. This marks a transformative step in the evolution of digital payments in New Zealand, delivering a comprehensive, secure, and efficient payment acceptance solution for merchants nationwide.

With Tap to Pay on iPhone integrated into ANZ FastPay Tap, merchants can easily accept Mastercard and Visa contactless card and device payments on both iOS and Android devices. The solution is designed to be low-cost and hassle-free, requiring no contracts or short-term rental fees. By simplifying payment acceptance, it enables merchants to serve customers quickly while reducing reliance on traditional point-of-sale (POS) systems.

The introduction of Tap to Pay on iPhone is pivotal for New Zealand businesses, where iPhones hold a dominant market share, thanks to their trusted security features, user-friendly integration with other Apple devices, and robust encryption capabilities. Tap to Pay on iPhone gives businesses and consumers confidence in the safety of every transaction, meeting the growing demand for reliable, contactless payment solutions while maintaining customer trust.

Using ANZ FastPay Tap, merchants can now accept contactless payments on an iPhone. That means they can accept most types of in-person, contactless payments—from physical debit and credit cards, to Apple Pay and other digital wallets.

“FastPay Tap gives businesses another way to accept flexible, fast and secure payments on the go,” says ANZ New Zealand Managing Director for Business Lorraine Mapu. “We can see it being handy for businesses during the busy summer period, when outdoor markets and festivals are on, and are pleased to be the first bank in New Zealand to roll it out.”

Barry Levett, CEO at Mypinpad, says, “We’re proud to work with ANZ on this launch, especially providing merchants a great user experience on both the Android and iOS platforms.”