As everyday transactions become smarter and more connected, Mypinpad leads the way with breakthrough consumer device solutions. Our technology redefines how payment interactions take place—enabling secure, seamless access anytime, anywhere. Designed to support a wide range of use cases, our solutions meet the evolving demands of both consumers and businesses with trust and flexibility at their core.

What is Mypinpad’s Consumer Device Innovation?

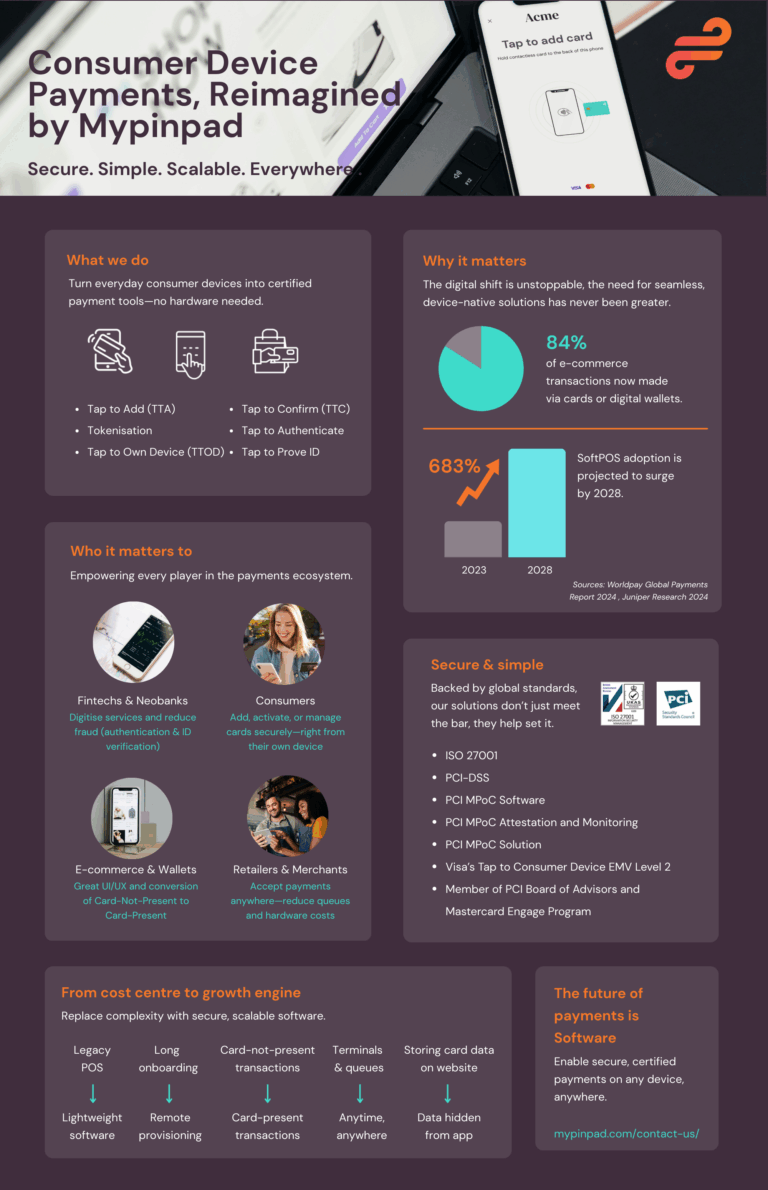

Mypinpad’s consumer device innovation enables consumers to make secure, card-present transactions using their own NFC-enabled smartphones—without the need for a merchant’s payment terminal, or to visit an ATM or bank. By turning everyday devices into trusted payment/verification tools, this technology supports use cases across e-commerce, banking, peer-to-peer transactions, and more. It delivers a seamless, contactless experience while maintaining the highest standards of security.

Our consumer device innovation can be broken down into 3 prevailing use cases:

Tap to Own Device (TTOD): Consumers can make card-present payments directly on their own NFC-enabled smartphones—no need for a merchant terminal. Still in pilot, TTOD enables card-present payments in digital environments, improving approval rates and reducing fraud, chargebacks and disputes through liability shifts.

Tap to Add (TTA): A fast, secure way to digitise a payment card. Consumers simply tap their physical card on their smartphone to provision it into a mobile wallet. This also enables tokenisation for future e-commerce use, supporting a seamless transition from physical to digital payment credentials.

Tap to Confirm/Verify (TTV): A tap-based method for verifying a payment card’s authenticity. This anti-fraud measure confirms the card is in the user’s possession—helping to prevent account takeovers, fake card enrolments, and identity fraud during digital onboarding or high-risk transactions.

“Mypinpad’s consumer device innovation isn’t just a new payment method; it’s reimagining how we interact with our devices on a daily basis,” says Barry Levett, CEO at Mypinpad. “We are setting the stage for a future where transactions are truly frictionless, empowering both consumers and businesses in new ways.”

How Does It Work?

Mypinpad’s consumer device technology makes secure interactions effortless. Whether adding a card, making a payment, or verifying ownership, the process is fast, intuitive, and designed with user convenience in mind.

To make a payment (TTOD), users tap their physical card to their NFC-enabled phone, enter a PIN if required, and complete the transaction.

To add a card (TTA), users simply tap their card on their own device. The card is instantly loaded into their digital wallet—ready for tokenised use in e-commerce or contactless payments.

To verify or confirm a card (TTV), a user may be asked to confirm they physically hold the payment card. Rather than entering card details manually or uploading images, they simply tap the card to their phone.

Global Reach, Unmatched Potential

With 84% of e-commerce transactions now made via cards or digital wallets, the shift to digital payments is undeniable. SoftPOS adoption is projected to surge by 683% by 2028—a clear signal that the future of payments lies in the palm of your hand.

In a world where mobile devices are everywhere, our software-first approach ensures that any business, anywhere, can offer secure, seamless payment experiences—without the need for extra hardware. This isn’t just global reach. It’s global readiness.

>> Read our article on the benefits of adopting Mypinpad’s consumer device solutions

Sources: Worldpay Global Payments Report 2024 , Juniper Research 2024