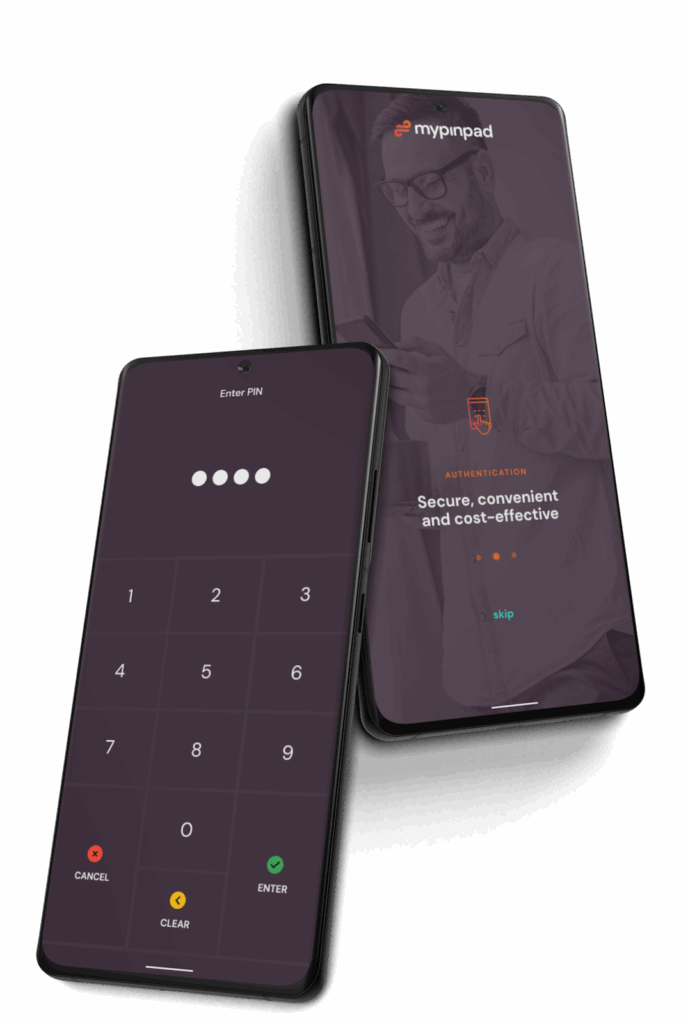

Mypinpad Authentication enables secure user verification on mobile devices using Tap-to-Verify technology and biometric/ID-based step-up methods, eliminating the need for passwords.

Tap-to-Verify allows users to authenticate themselves by tapping their bank card against their own NFC-enabled device, combined with secure PIN entry if required. This method is secure, frictionless, and aligns with strong customer authentication (SCA) requirements.

Any organization that needs to verify customer identity for online, in-branch, or remote services—such as banks, fintechs, and government agencies—can implement Mypinpad Authentication.

Yes, Mypinpad Authentication complies with global data protection and financial regulations, including GDPR, PSD2, and eIDAS, and is certified under PCI MPoC standards.

Yes, Authentication can be deployed as a standalone app or integrated via SDK into existing customer-facing apps for mobile onboarding and remote verification workflows.